Recognizing Insurance Policy Choices For Substance Abuse Treatment: An Overview

Recognizing Insurance Policy Choices For Substance Abuse Treatment: An Overview

Blog Article

https://telegra.ph/Discover-The-Concealed-Facts-Of-Drug-Dependency-Unveil-The-Profound-Effect-It-Has-On-Your-Body-And-Mind-Locate-Hope-In-Efficient-04-30 By-Wyatt Kofod

Imagine browsing insurance protection for Drug rehabilitation as trying to assemble a complicated challenge. Each item stands for a different aspect of your plan, and the difficulty lies in straightening them perfectly to guarantee extensive protection.

Comprehending the details of insurance coverage can be complicated, yet fear not, as we break down the essential parts that will empower you to make enlightened decisions and protect the support you require.

Understanding Insurance Policy Coverage Fundamentals is the very first step in your journey to taking full advantage of the advantages readily available to you.

Comprehending Insurance Coverage Insurance Coverage Basics

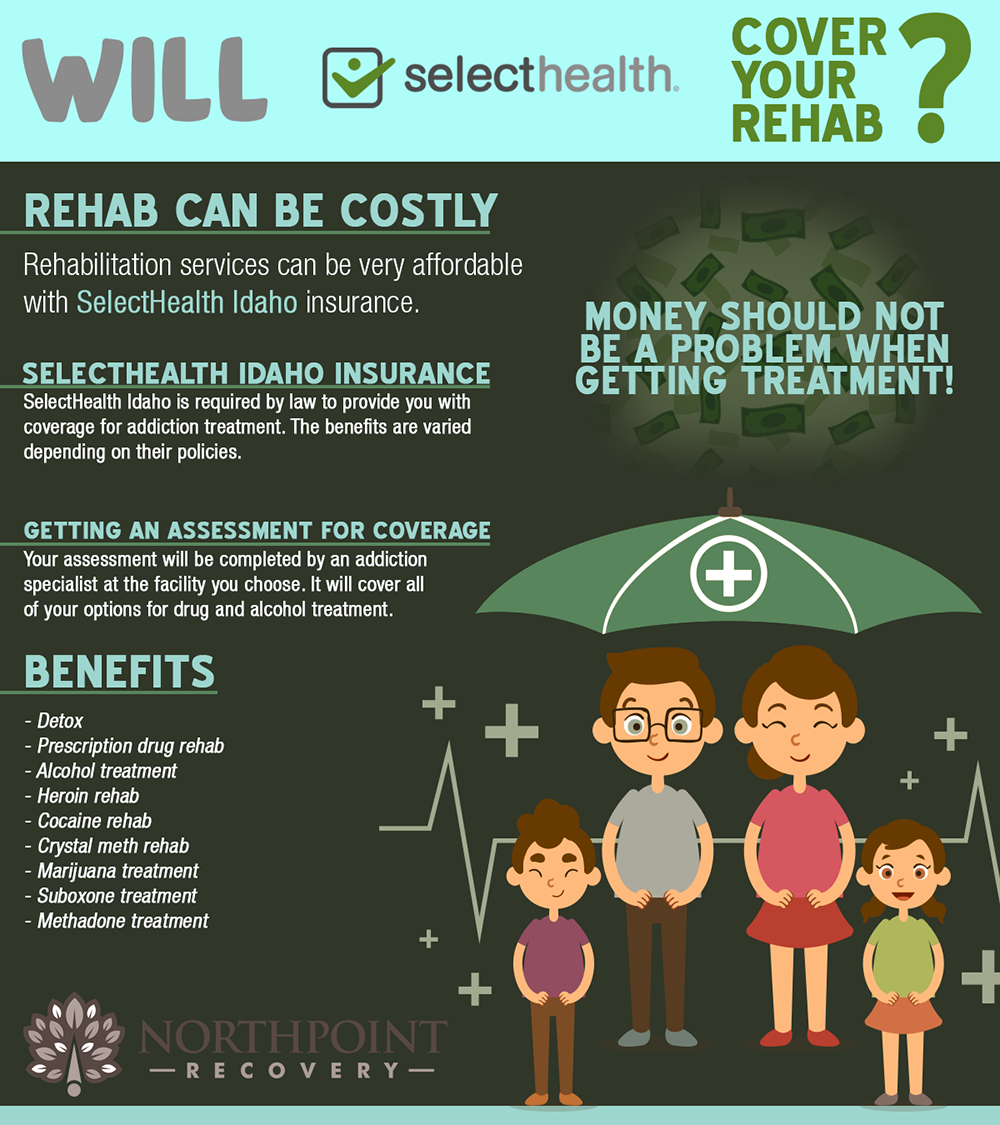

To comprehend the fundamentals of insurance coverage for Drug rehab, start by recognizing how your plan features. Look into whether your insurance policy strategy consists of mental wellness and drug abuse benefits. Inspect if there are any type of details needs for coverage, such as pre-authorization or recommendations.

Recognizing your deductible and copayment duties is crucial. Familiarize yourself with the regards to your plan, like in-network service providers versus out-of-network companies. Recognizing the degree of coverage your insurance policy offers for different kinds of therapy programs will certainly help you intend successfully.

Keep https://zenwriting.net/jarred0arlene/discover-the-hidden-realities-of-drug-dependency of any constraints on the variety of sessions or days covered to prevent unexpected expenses. Being proactive in understanding your insurance coverage can make a substantial distinction in accessing the care you need.

Key Elements for Insurance Coverage Decision

Understanding key factors that establish insurance coverage for Drug rehab under your insurance plan is vital for navigating the procedure efficiently.

The major factors that influence insurance coverage include the type of therapy center, the particular services given, the period of treatment, and whether the facility is in-network or out-of-network.

In-network centers are usually more budget-friendly due to the fact that they have actually bargained rates with your insurance provider.

Furthermore, your insurance policy strategy might need pre-authorization for therapy or have specific standards that should be satisfied for insurance coverage to be approved.

It's crucial to review your plan carefully, recognize these vital factors, and communicate successfully with your insurance policy copyright to ensure you maximize your coverage for Drug rehabilitation.

Tips for Maximizing Insurance Coverage Conveniences

To make the most of your insurance coverage advantages for Drug rehabilitation, it is necessary to be positive in discovering methods to enhance insurance coverage. Here are some ideas to assist you maximize your insurance advantages:

- ** Evaluation Your Policy **: Understand what your insurance covers and any restrictions that might use.

- ** In-Network Providers **: Select rehabilitation centers and health care specialists that are in-network to minimize out-of-pocket expenses.

- ** Utilize Preauthorization **: Acquire preauthorization for treatment to make certain insurance coverage and prevent unexpected expenses.

- ** Charm Denials **: If a case is refuted, don't wait to appeal the decision with added info or assistance from your healthcare provider.

https://www.addictioncenter.com/treatment/therapy-for-addiction-recovery/ as a compass overviews a ship with treacherous waters, understanding insurance policy coverage for Drug rehabilitation can navigate you in the direction of the best therapy path.

By recognizing the basics, crucial elements, and pointers for taking full advantage of advantages, you can stay away from challenges and get to the security of recuperation with self-confidence.

Let your insurance coverage be the guiding light that leads you towards a brighter, much healthier future.